5 Tips for Reading a Foundation’s 990

This blog post is sure to get a ton of hits because here’s where I’m talking about the world’s sexiest tax document of all time: Form 990!

But seriously. If you’re applying for grants to fund your art, you will surely read several 990s in the process. And if you’ve previously applied for a grant without looking at the grantmaker’s 990, you’re doing grants wrong. What is a 990? Great question. It’s the tax form that certain nonprofit entities, like foundations, need to file with the IRS every year. I’m guessing that you don’t spend your spare time perusing tax documents, because you’re sane, and I admit that scrolling through a 100+ page PDF containing a funder’s financials can be overwhelming. Here are a few quick tips for getting the most out of a foundation’s 990 without losing your mind. First off, just know that the 990 can be a treasure trove of useful information for you as a grantseeker. You just need to know where to look and suddenly a sprawling tax document can seem a lot less intimidating. When looking for grants, it’s a good idea to start with online searches with services like Foundation Center to generate a large list of prospects. Once you know who to target, you can then take a look at their 990s to whittle down your list to the funders for whom you are the best fit. Grantmakers’ 990s are publicly available on The Foundation Center website and also on GuideStar.

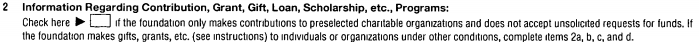

- Learn about a funder’s submission process. When I’m looking at a 990, the first thing I do is scroll down to Part XV, where you can learn more about how a grantmaker accepts applications. This is especially useful if the foundation does not have a website with info about how to submit. Sometimes the 990 will include a description of the types of requests that they fund, what to send the funder, any supplemental documentation to provide with your submission, and the contact info for the person to whom your request should be addressed. But most importantly, Part XV asks a crucial question to which you should pay special attention.

- If the foundation has this box checked off, then there are two things you can do. Maybe you decide to cross this funder off your list of prospects as they do not offer a competitive funding opportunity. Or, you can see if there’s a way to make it onto their list of preselected charitable organizations.

- Find out who works for the foundation and who is on their Board of Directors. Part VIII of the 990 will list the highest paid employees at the foundation (if applicable) as well as the members of their Board of Directors. If the funder states that they only support preselected organizations, you can take a look at this list of names, share it with your inner circle, and see if anyone that you know is friendly with a member of their Board and can facilitate an introduction. Even if the foundation does offer a competitive funding opportunity where they accept unsolicited proposals, this can be a good way to make the acquaintance of key decision-makers. Putting together a winning proposal is important, but fostering relationships with funders is often an equally vital part of successful grantseeking.

- Look at who they have funded previously. As you’re narrowing down your list of grant opportunities to those for which you are most qualified, you should start to investigate who a given grantor has funded in the past. Part XV of the 990 will include a list of that year’s grant recipients. For institutions that award a lot of grants in a given year, the full list might be toward the very end of the 990 as supplementary information. Scroll through the names and if you’re not familiar with the recipients, do some light Googling to find out more about their work. When you discover that a foundation awards grants to individuals or organizations who are similar in size, scope, or mission to you, then you’re looking at a very, very good prospect. Other funders might look great in all other respects, but then you learn from the 990 that they only fund big nonprofits like The Metropolitan Opera or medical-research projects or organizations in Orange County, to use a few hypotheticals. You can then safely cross that funder off your list because they are not an appropriate fit (unless you’re The Met, do medical research, and/or exist in Orange County).

- Pay attention to the award amounts. When you look at who received funding from a given grantor, you can also see the size of the grant that they were awarded. You’ll have a sense for the range of award amounts that a funder offers. This can serve a couple of purposes. First off, it will continue to help you evaluate your competitiveness for a given foundation. If they only offer grants of $100K or more, and your total budget is only $10K, then now is not the time to apply. But also, it will help you come up with an appropriate ask amount if you ultimately do decide to submit a proposal. It stands to reason that, if a foundation only awards grants of $5K or less, you shouldn’t ask for much more than that when you send your proposal.

- Sometimes no information can still be useful. Let’s say you’re researching a funder and they don’t have a website. So you pull up their 990 and none of the four tips above apply. There’s literally no info or the info provided appears useless. This actually might be more helpful to you than you might think. It could portend that they have taken a hiatus from actively awarding grants or are dissolving. You could see if there’s any contact info whatesoever — like a phone number or email address — to try to connect with someone at the foundation to gather more details. If you’re ultimately unable to glean any useful info from their 990 or contact someone with the funder, then it’s likely a waste of your time to submit a proposal to them and you should, with no reservations, cross this foundation off your list.

I encourage you to navigate over to GuideStar, look up a foundation, and take a look at their 990 RIGHT NOW to see if you can quickly put these tips to use. Then, the next time you’re researching prospective grant funders, you will hopefully have more confidence in your ability to find information that will be useful as you move forward. Some further reading on this topic: Highlights of IRS Form 990 by GuideStar Demystifying the 990-PF by Foundation Center.

For more information about getting funding as an artist, check out Fundraising for Artists: The Ultimate Guide!

About Nathan Zebedeo

Nathan Zebedeo is a graduate of NYU’s Tisch School of the Arts. In 2011, Nathan made the leap from card-carrying member of Fractured Atlas to an associate on our programs team, which he now co-manages. Prior to joining Fractured Atlas, Nathan helped produce celebrity author events at Barnes & Noble’s flagship Union Square location. Outside of work, Nathan directs the occasional play. He enjoys board games, learning languages, and travel.